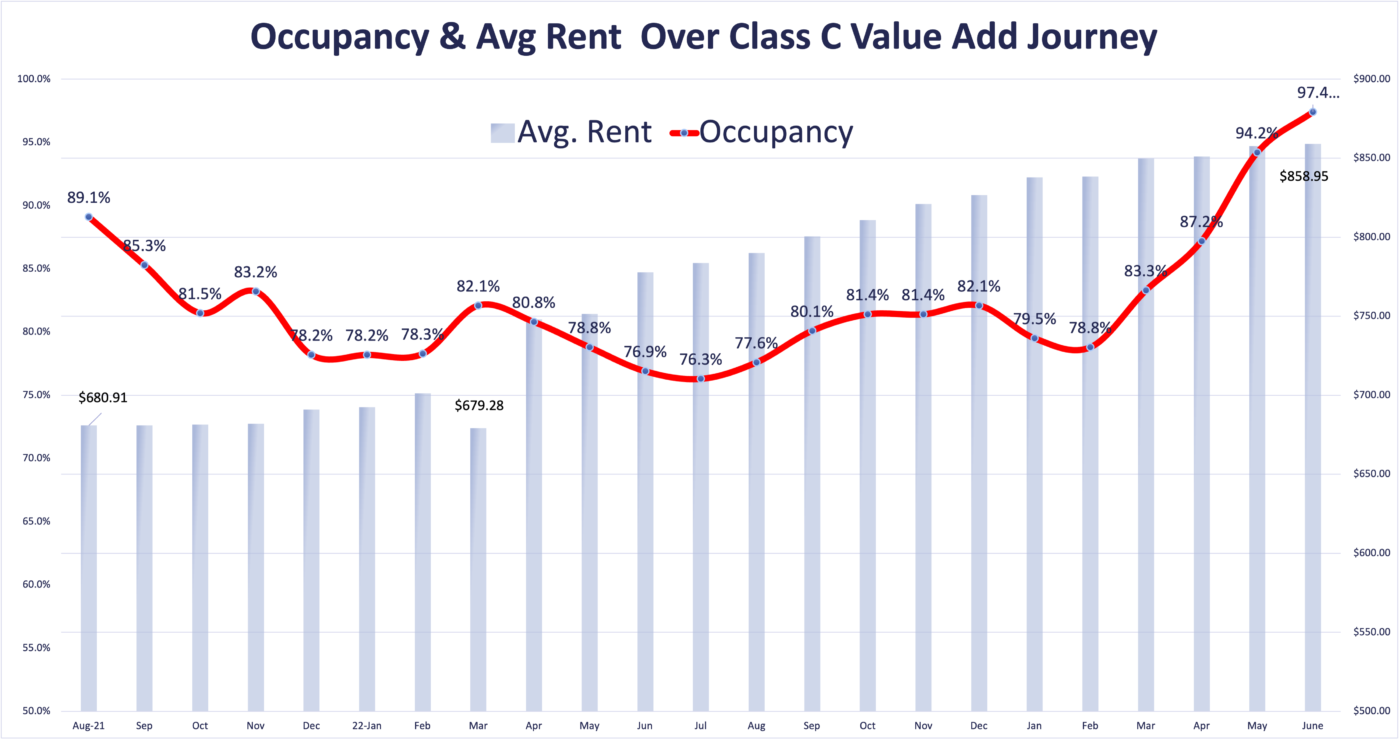

We are approaching our 2 year anniversary on a Class C Value Add.

It hasn’t been easy.

As you can see from the red line, occupancy has been a challenge.

We are now in a much stronger position with occupancy at 97-98%. We will stabilize occupancy over 95% on our 2 yr anniversary.

In an after action assessment on our performance, some items are obvious and some are counter-intuitive.

Key Learnings (reinforced & new):

🎒 Bank Draws are crucial to success. From Oct of Year 1 to Sep Year 2 we battled with the bank over bank draw payments and timing. It dramatically impacted our timeline and delivery of units to market.

🎒 Fire faster. We changed PM company in Month 10. The change took 60 days to implement so we should have made the decision in Dec or Jan.

🎒 We have a massive delivery of rehabbed units in Feb/March this year. Occupancy climbed.

🎒 Seasonality does exist over Nov-Jan

🎒 Avg Unit Rent is not always correlated to property occupancy. You CAN raise rents even when vacancy is present. We started at $~680 and should finish Year 2 at ~$860 +$190/Unit/Month.

🎒 Mark to Market is a metric that must ALWAYS be forebrain. We grew it by stewarding resources where our largest unit rent gains were achieved with the lowest rehab expense. It made a huge difference.